How Do Leading Brands Defend and Grow Their E-commerce Market Share?

Blogs

– An article by Vaibhav Dabhade, Founder and CEO of Anchanto

I’m often asked about my views, opinions, and how I feel about the year 2024 in the backdrop of the global e-commerce landscape. As someone who has been closely monitoring the industry even before it became the norm globally, I call this year the ‘Year of the Reality Check’ for e-commerce.

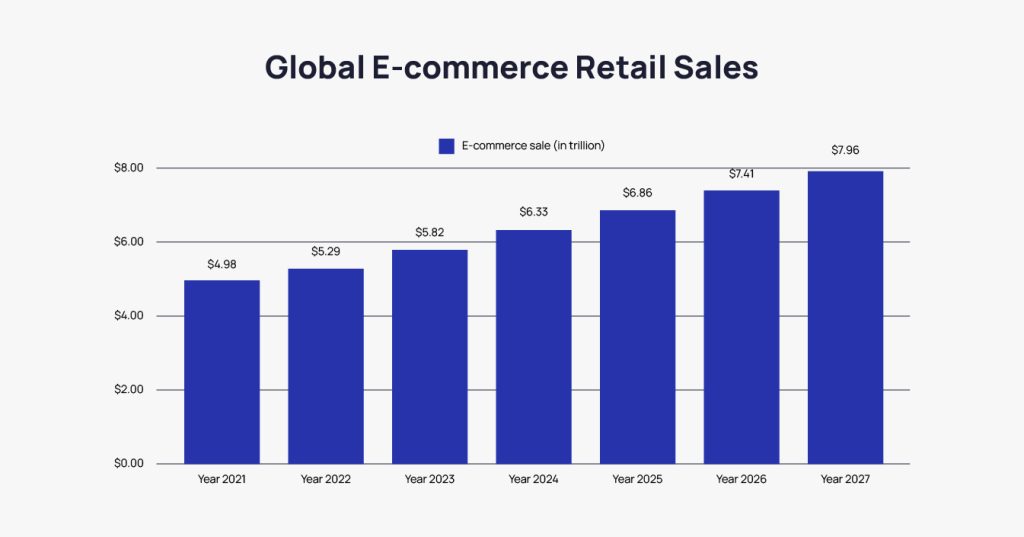

This is because the early days of e-commerce hypergrowth in the world are quite visibly over. Several markets and ecosystems are finally consolidating after years of fragmentation. In fact, revenue in the e-commerce market is projected to reach $4.1 trillion in 2024 [1]. It’s expected to grow at an average annual rate of 9.49%, reaching $6.5 trillion by 2029.

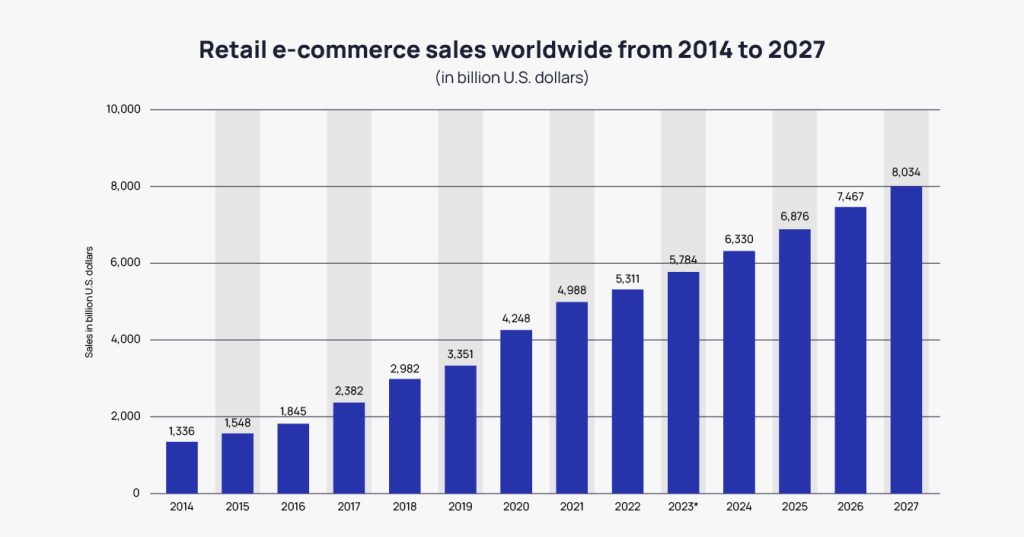

Clearly, the market is now entering into a phase of ‘predictable growth.’ The penetration has reached a phase with limited variation as shown in the graph below and marketplace environments are entering the phase of ‘early maturity.’

Source: Wthrift.com [2]

Source: Statista.com [3]

All this indeed sounds positive, but I note that this is where the inevitable reality check comes in: For e-commerce businesses, growth will be more difficult hereon. And businesses will be naturally compelled to introspect even the way growth is measured.

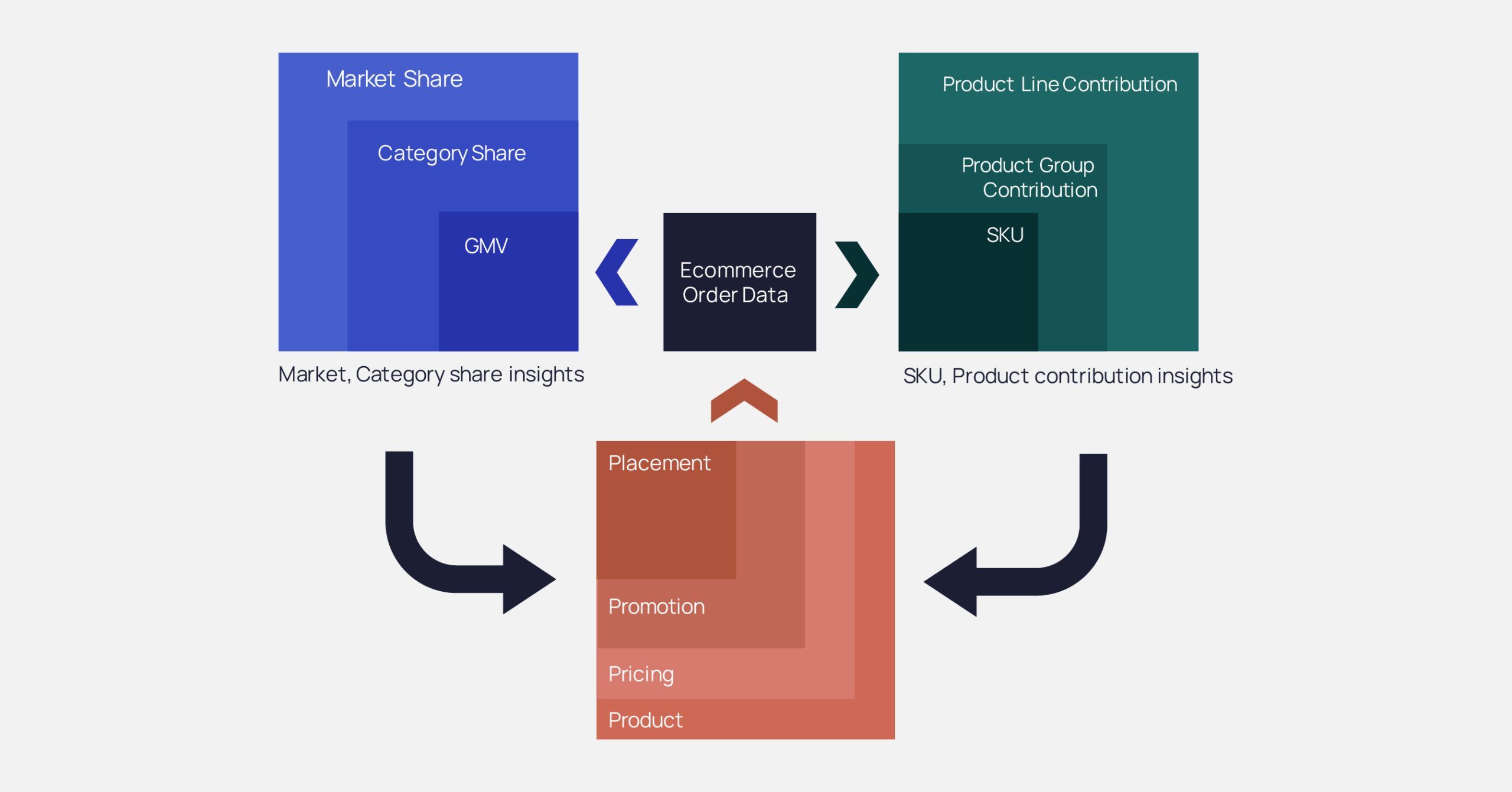

Currently, analyzing only the Gross Merchandise Value (GMV) is the primary way e-commerce businesses measure their progress. But this will no longer be enough. What they need to focus on is their e-commerce market share. But before I explain further, let me share the implications that market consolidation brings with it.

4 Main Implications that We Start to Witness

As the e-commerce market transitions into a phase of predictable growth and early maturity, several significant implications are becoming evident. This period marks a shift in strategies for businesses aiming to defend and expand their market share. These changes will reshape how leading brands operate, innovate, and sustain their presence in the ever-competitive e-commerce arena. The clear implications of the evolving e-commerce industry can be summarized through the following observations:

- Decreasing investments by marketplaces

For a prolonged period now, almost all brands and retailers have been benefitting from the lucrative opportunities fueled by marketplace spending. Special sales like 11.11, Black Friday, Lunar New Year, etc., have been great platforms for brands to enhance the attractiveness of their online channels. But marketplaces are gradually decreasing the subvention of their official sales thus eliminating that extra boost for brands to sell more and capture a greater market share.

- Faster impacts on sales trends due to changing consumer behaviors

Dominated by a young population, it is no surprise that consumer behaviors and expectations change at a fast pace. For brands, this pace becomes crucial since it directly impacts their sales and revenue if they don’t keep up with it. This is why e-commerce presence requires constant optimization and market watch. This inherent complexity is also multiplied by the volume of the assortment they handle and distribute.

- Availability of data with immense potential to be tapped

As most brands have now been selling online for a few years, there is a lot of solid historical data available. This data has enormous potential for them to understand, predict, and elevate their performance. This is also applicable for marketplaces and technology providers.

- Rising competition intensity

While e-commerce growth is stabilizing, it keeps attracting new entrants. Whether they are ambitious brands or traditional retail late-comers, they all hope to get a share of the giant e-commerce pie. But the size of the pie does not grow at the same speed, which aggravates the competition further.

As I frequently find myself deliberating these subjects with my industry peers, I get to see firsthand how different brand leaders respond to these implications in their own ways. And that has made me realize how the top brands, including the Fortune 500s and even the successful Digitally Native Brands (DNBs) do things differently to always stay one step ahead.

4 P Marketing Strategies Followed by Leading Brands

Leading brands employ 4 specific strategies to maintain their edge. From understanding the nuances of product performance to optimizing pricing, leveraging promotions, and ensuring effective placement, these strategies are critical to driving growth and staying ahead of the competition. By examining how they implement these practices, other brands can also gain insights into thriving in a rapidly evolving market.

To give you a glimpse into the 4 P strategy employed by leading brands here are a few detailed observations:

Product

The first P focuses on the product and how to improve it in terms of quality, personalization, and offerings. Market leaders in e-commerce also focus on product information management and catalog quality. They identify their product content “quality score” and where it can be improved. With keyword-related insights based on their product, category, and how product descriptions and images, they can improve their product listings to enhance shopper interest and conversion rates.

Leading brands also look for specific information like SKU/ group performance trailing SKU (or underperforming SKU) analysis. By enabling relevant data distribution, all of the brand’s teams enter the execution mode as soon as the data is available, giving the brand a natural edge over competitors.

Pricing

When it comes to pricing, businesses must ensure they operate profitably. However, pricing is more complex than simply calculating the cost of goods and adding a desired profit margin. The way a brand prices a product communicates its perceived value and quality. To determine the best price for their products leading brands observe price trends to avoid price wars.

Market leaders never engage in price wars as this practice tarnishes brand reputation and leads to a loss of customer trust and loyalty, affecting long-term revenue streams. Additionally, price wars erode financial health over time, hinder innovation and product development, and create an atmosphere of instability and uncertainty within an industry.

To stand out, leading brands focus on value and differentiation to foster loyalty. At the same time, they also observe price trends to ensure their product pricing is optimized and their products are never over or under-priced.

Promotion

Promotions play a vital role in online retail. They help create awareness about brands, increase visibility, and ultimately drive more traffic to online stores. But as you guessed it, market leaders go a few steps ahead. While they do monitor their own promotions, they also compare their promotion strategies with competitors.’ This is aimed to determine what is leading to their sales and if they’re doing enough to earn more to protect their market share.

Besides conducting promotion comparisons, leading brands also experiment with their promotions. They track the impact of their different promotions on sales. By running experiments and analyzing the results, they identify the optimal strategies for their products and target audience across each sales channel they use.

Placement

The final P of the marketing mix refers to placement. It is the part that covers where brands sell their products. But leading brands concentrate on GMV in the ‘right context’ of category when it comes to product placement.

Looking differently at the same data that every brand reviews helps drive vastly different discussions, strategies, actions, and outcomes. Brands usually analyze information like Gross Merchandise Value (GMV), order volumes, and inventory levels. Leaders, on the other hand, analyze this information in the context of ‘Category.’

So, while other brands focus on the growth in GMV and order volumes, leaders look at category growth (or share of search), market share and growth differential.

As an example, a certain ‘Brand A’ may conclude their analysis as: In a month, GMV grew by 18% taking it as a positive sign of growth in the market.

But, a more thorough analysis in the context of category and with a competitor will reveal that while Brand A grew revenue by 18%, they lost 4% category share, and their nearest category competitor drew close to them by 35%. Moreover, the new category interest grew by 10% while capturing most of the category size growth.

This is how the context puts leading brands extremely close to the reality of the market and in a much better position to take definite action.

In conclusion, market leaders are able to take a massive lead by just doing each of the above steps differently. They exemplify the importance of data-driven agility and innovation in maintaining a competitive edge.

I have always deeply admired technology’s ability to level the playfield. When it comes to e-commerce, there is no dearth of examples of DNBs and startups that have secured their share of the pie competing against established businesses.

So even now in this ‘Year of the Reality Check,’ by rethinking traditional approaches to data analysis, empowering decision-making through tailored insights, implementing targeted 4P marketing strategies, and embracing agile responsiveness, all businesses can not only defend but grow their market share. And this has been one of the key outcomes Anchanto has been pioneering across Southeast Asia, the Middle East, and Europe.

Implement the Strategies of Leading Brands with the Right TechnologyReferences –

[1] – Statista.com – eCommerce – Worldwide

[2] – Wethrift.com – E-commerce and Online Shopping Statistics in 2024

[3] – Statista.com – Retail e-commerce sales worldwide from 2014 to 2027